The Debt That’s In Demand

By Raymond Hu, Senior Investment Director – Head of Real Estate Credit October 10, 2023 Not so long ago,...

November 17, 2021

One of America’s Founding Fathers, Benjamin Franklin, coined the phrase “do well by doing good” to highlight that individuals, organizations, and governments can do well for themselves by doing good for their constituents. The idea originated when Franklin recognized his increasing wealth and the community’s increasing well-being were being achieved in part through his contributions of intellectual capital. However, by the turn of the 21st century “Wall Street” had prioritized corporate success over all other things, and the idea of doing “good” had taken a back seat to profit maximization. Pundits of that time even had the support of academia who argued that doing good was in opposition to doing well (negative screening of “sin stocks” resulted in worse investment performance). Today, the research, school of thought, and approach to impact investing has evolved considerably. Research has observed risk reduction in impact/ESG approaches, Wall Street has embraced it, and negative screening approaches have waned in favor of more integrated impact approaches that may be accretive to performance.

In Part One and Part Two of our Case for Affordable Housing series, we highlighted the accretive performance benefit of the asset class. We explained that the lower risk profile of the asset, made possible by supply and demand imbalances, led to higher occupancy and collections levels. We discussed how LIHTC properties, which have historically fallen below the institutional radar, provide better valuations relative to similar class B market rate properties. We also spent time delving into rental growth in affordable properties which have historically outpaced the growth of market rate properties (and with much more consistency and resilience). In Part Three, we shift our focus to the “doing good” piece of the “doing well by doing good” puzzle and highlight why our three-pronged approach to affordable housing “just works.”

CREATION, PRESERVATION, AND IMPROVEMENT

On average, renters spend about 30% of their income on rent with the remaining percentage being used for items like food, healthcare, childcare, transportation, education, etc. However, many low-income families across the country are rent-burdened, paying in some cases, more than 50% of their household income towards rent. The resulting effect for those families is a severe drop in available income for food, healthcare, and other basic needs. This in turn perpetuates the wealth gap for future generations among low-income families. Affordable housing plays an important role in breaking that link and redistributing that spending imbalance to ensure families are fed, healthcare needs are met, and children receive proper care and education.

Our preferred approach to affordable housing, and first area of impact, is an acquisition strategy where we purchase affordable and workforce multifamily housing. The primary goal, and the biggest impact we can provide, is to preserve, create, and improve affordable units for low-income families at these properties. Over the past five years our affordable housing strategy has purchased 24 properties encompassing 4,626 units, including 2,334 affordable units, and created 350 new affordable units. We have also made numerous improvements in units and provided additional amenities that we believe have resulted in a higher standard of living for our tenants while maintaining affordable rents.

ENVIRONMENTAL IMPACT

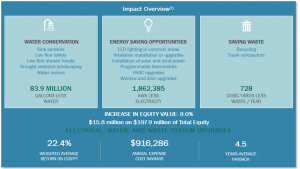

The second area of impact we target in our affordable housing approach is to engage in environmental improvements at the properties we own. Our strategy of acquiring primarily older vintage properties provides ample opportunity for value-add improvements to reduce water consumption, energy consumption, and waste. Improvements like sink aerators, low flow toilets, drought resistant landscape, and water meters can produce significant water and cost savings that contribute to the reduction in our carbon footprint and NOI expansion. The same is true for LED lighting, solar programs, HVAC upgrades, recycling, and so on for energy savings and waste reduction. Our environmental improvements delivered an accretive return on cost of 22.4% and saved approximately 84 million gallons of water (~4,000 backyard pools), 1.9 million kWh of electricity (~350 years running a lightbulb continuously), and over 700 cubic yards of waste (~4,600 trash cans).

(1) Includes all historical return of capital (“ROC”) and annual savings for properties owned by Kairos where utility savings projects were installed. Includes assets that have been sold and the data is not specific to a given year. For that reason, the ROC is calculated using the savings seen immediately after the utility project was installed.

(2) Calculated using the sum of the first year of savings post utility investment installment (or earliest available year of data if first year not available), divided by the cumulative cost of the projects.

SOCIAL PROGRAMS

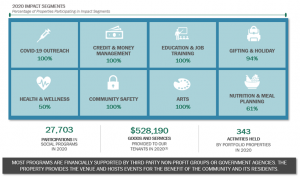

The third area of impact we focus on is social programs that benefit our tenants and the communities around them. Tenants of affordable properties must meet low-income requirements to qualify for acceptance and thereby benefit greatly from social programs aimed to aid across a number of impact areas. We partner with third party non-profits, academic institutions, and government agencies in the communities we serve to provide services across 8 primary themes shared below. These services provide both a direct and indirect financial benefit which supports tenants’ ability to pay rent. We have also found that these programs create a sense of community and serve as an additional amenity which results in lower unit turnover and reduced operating and capital costs. Job training, money management, and other programs also address systemic issues with poverty and hopefully play a part in reducing the wealth gap inherent in many of the minority and underserved groups we serve.

(1) Goods and Services provided to our Tenants in 2020: $370,700.26 is from rent relief provided to our tenants, who applied and received assistance through various sources e.g., federal, state, county, non-profits and churches, as a result of the pandemic.

We are hopeful that our focus on quality affordable housing has positively impacted the standard of living and quality of life for thousands of low-income families. The environmental improvements have had a direct impact in water, energy, and waste reduction while being accretive to investor returns. We believe our social programs contributed to the sense of community and provided a benefit to tenants that we hope will continue to help narrow the wealth gap and reduce our investment risk. Affordable housing can do so much good for those that need it most, but unfortunately it remains critically undersupplied in this country. By creating a strategy that can do well in this niche, we believe we have created an enduring solution to do good.

Review Part One and Part Two of our Case for Affordable Housing series here: Part One – Seeking Stability During A Recession and Part Two – Finding Growth in Unexpected Places. For questions, contact investor relations at investorreporting@kimc.com or 949-800-8500.

*All data as of 12/31/2020

**Certain information contained herein has been obtained from third party sources and such information has not been independently verified by Kairos. No representation, warranty, or undertaking, expressed or implied, is given to the accuracy or completeness of such information by Kairos or any other person.

***There are no guarantees that any specific investment strategy will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss.

Back to All

Back to All

By Raymond Hu, Senior Investment Director – Head of Real Estate Credit October 10, 2023 Not so long ago,...

Authored by Jonathan Needell, President and Chief Investment Officer August 19, 2021 (reposted from LinkedIn article published on December...

Authored by Jonathan Needell, President & Chief Investment Officer August 28, 2020 In the United States, the ongoing COVID-19...

Authored by Jonathan Needell, President and Chief Investment Officer November 4, 2021 Fannie Mae and Freddie Mac (the “Enterprises”)...

Authored by Jonathan Needell, President and Chief Investment Officer December 15, 2021 The U.S. has entered a period of...

Authored by Jonathan Needell, President and Chief Investment Officer August 19, 2021 (reposted from LinkedIn article published on April...

Authored by Trevor Schuesler, Investment Director and Raymond Hu, Head of Real Estate Credit September 27, 2022 In the...

Kairos Investment Management Company (KIMC), a $4.2 billion real estate private equity and debt platform headquartered in Irvine, California,...

18101 Von Karman, Suite 1100

Irvine, CA 92612

(949) 709-8888

(949) 800-8500

investorreporting@kimc.com

Copyright © 2024 Kairos Investment Management Company | Disclosures

Kairos Investment Management Company is an Equal Opportunity Employer and, as such, does not discriminate in employment on the basis of an applicant or employee’s race, ethnicity, ancestry, national origin, color, sex, pregnancy (or related medical conditions), childbirth, family status, gender, gender identity or gender expression, age, religion, marital status, sexual orientation, disability, medical condition, military or veteran status, reproductive health decision making, or any other protected classification or characteristic under applicable federal, state or local law. Kairos will not discriminate against an applicant or employee who has one or more protected classifications, is perceived or regarded as having one or more protected classifications, or is associated with someone who has one or more protected classifications.

Kairos Investment Management Company will also provide reasonable accommodations to applicants and employees who may need such accommodations in connection with employment with Kairos on the basis of their disability, religion, status as a victim of domestic violence or pregnancy. An applicant who needs an accommodation in order to pursue employment with Kairos should contact Human Resources at HR@KIMC.com to request such accommodations. Kairos will engage in a good faith interactive process with the applicant to explore accommodations that will be effective, reasonable and not create an undue hardship.

You can see how this popup was set up in our step-by-step guide: https://wppopupmaker.com/guides/auto-opening-announcement-popups/

You can see how this popup was set up in our step-by-step guide: https://wppopupmaker.com/guides/auto-opening-announcement-popups/