Analyzing Alternative Versus Traditional Lenders in Today’s Environment

Authored by Raymond Hu, Senior Investment Director – Head of Real Estate Credit June 7, 2023 At one time,...

By Justin Salvato, Senior Partner at Kairos Investment Management Company

October 23, 2023

Not long ago, capital deployment was a more “straightforward” matter. Traditional lenders, like banks and credit unions, were hungry to back a variety of commercial real estate investments, developments, and acquisitions. Developers and investors, in turn, were encouraged by low interest rates and plenty of available liquidity to buy and build.

As we know, this is no longer the case.

Traditional lenders have significantly reduced their commercial real estate exposure. This has led to tighter lending requirements and less available debt. Furthermore, the volatile interest rate environment makes it more costly for borrowers to finance acquisitions, support developments, and refinance maturing loans.

Deals are still getting done. That said, these deals are fewer and fewer in between, and it’s taking longer to capitalize them.

Additionally, much of today’s capital deployment is taking the form of recapitalization. And that recapitalization is in the form of “rescue” capital.

Changes to the Capital Stack

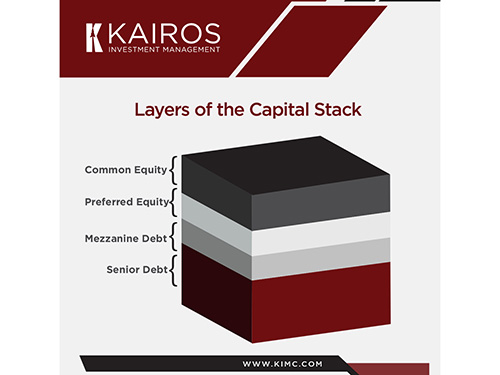

Successfully supporting real estate transactions may require different forms of capital rather than traditional debt and equity. The capital stack may now have some or all of the following “layers”:

Senior debt, also called mortgage loans, is the base of the capital stack. The borrower repays senior debt regularly, regardless of how a real estate project performs. Senior debt also has the highest claim on an underlying asset if the borrower should default on loan payments.

Mezzanine debt—sometimes known as “subordinated” debt—is a form of debt that is typically secured by a lien on the underlying asset. Mezz debt lenders also receive regular repayments, regardless of asset performance. These loans essentially bridge the gap between senior debt and equity, often priced at rates three-times as high as senior debt. In some cases, they also allow the lender to convert the debt into an equity interest in a real estate project.

Equity resides at the top of a capital stack where the most risk lies for an investor. Equity involves cash or cash equivalents that developers and/or owners invest in real estate projects. Within this layer are two types of equity: preferred and common.

Making an Impact and Unlocking Opportunity with Rescue Capital

During the days of plentiful and cheap capital, the senior debt “layer” was typically the largest of the capital stack. But in recent years, that top layer shrank as the mezzanine and equity layers expanded. In many cases, the mezzanine layer has grown, fueled by the need for rescue capital.

Rescue capital aims to support fundamentally sound projects that might have run into financial hiccups. Kairos has strategically deployed rescue capital in the following situations:

Projects Nearing the Finish Line

Many CRE developments commenced before inflation reared its ugly head in the form of materials cost overruns and higher labor costs. These developments might be 80%-95% or more complete in these situations, but stalled because they needed more cash.

Rescue capital can provide the necessary liquidity to get the project completed and leased up. In some cases, the lender of rescue capital can buy the project. This means that the lender both funds the completion and has an ownership stake in the property.

Projects Requiring Refinance

Plenty has been written about upcoming commercial real estate debt maturities. The issue is that much of the maturing debt will require refinancing. But two prevalent problems are that 1) fewer lenders are willing to offer capital, and 2) the current interest rate environment means capital costs more.

Rather than risking denial of their loan applications or having to add more equity to the mix, many investors and developers are instead opting for rescue capital. Such capital is provided through private vehicles, like those we manage. Unlike traditional lenders, which must adhere to various rules and regulations concerning financing, private capital is more flexible in determining loan terms, amounts, and rates.

Projects with Financial Gaps

In many cases, there can be a considerable gap in the capital stack between the shrinking senior debt and lower equity available from owners. Rescue capital can be a way to bridge that gap by providing liquidity that comes with flexible terms and rates of return.

Changing Times, Changing Capital Deployment

The capital landscape has changed in just a few short years. In that timeframe, the real estate industry has gone from plentiful senior debt to higher equity requirements, tighter lending standards and less available capital from traditional lenders. The result? Different capital deployment strategies.

In many ways, rescue capital can be an ideal tool for recapitalization. When appropriately deployed, rescue capital within the mezzanine debt portion of the capital stack can help investors maximize returns, minimize risk, and offer borrowers a much-needed financial safeguard amid the current economically volatile environment.

For questions, contact investor relations at investorreporting@kimc.com or 949-800-8500.

Back to All

Back to All

Authored by Raymond Hu, Senior Investment Director – Head of Real Estate Credit June 7, 2023 At one time,...

Authored by Jonathan Needell, President and Chief Investment Officer August 19, 2021 (reposted from LinkedIn article published on October...

Seeking Investment Stability During a Recession Authored by Trevor Schuesler, CFA, Associate Investment Director February 22, 2021 Since the...

Authored by Jonathan Needell, President and Chief Investment Officer February 17, 2022 Supply and demand in the housing market...

Doing Well by Doing Good Authored by Trevor Schuesler, CFA, Associate Investment Director November 17, 2021 One of America’s...

Authored by Jonathan Needell, President and Chief Investment Officer April 27, 2022 The debt markets are under a considerable...

Authored by Jonathan Needell, President and Chief Investment Officer March 18, 2022 Commercial real estate investors typically have an...

Authored by Jonathan Needell, President and Chief Investment Officer August 25, 2022 Measuring the gross domestic product (GDP) growth...

18101 Von Karman, Suite 1100

Irvine, CA 92612

(949) 709-8888

(949) 800-8500

investorreporting@kimc.com

Copyright © 2024 Kairos Investment Management Company | Disclosures

Kairos Investment Management Company is an Equal Opportunity Employer and, as such, does not discriminate in employment on the basis of an applicant or employee’s race, ethnicity, ancestry, national origin, color, sex, pregnancy (or related medical conditions), childbirth, family status, gender, gender identity or gender expression, age, religion, marital status, sexual orientation, disability, medical condition, military or veteran status, reproductive health decision making, or any other protected classification or characteristic under applicable federal, state or local law. Kairos will not discriminate against an applicant or employee who has one or more protected classifications, is perceived or regarded as having one or more protected classifications, or is associated with someone who has one or more protected classifications.

Kairos Investment Management Company will also provide reasonable accommodations to applicants and employees who may need such accommodations in connection with employment with Kairos on the basis of their disability, religion, status as a victim of domestic violence or pregnancy. An applicant who needs an accommodation in order to pursue employment with Kairos should contact Human Resources at HR@KIMC.com to request such accommodations. Kairos will engage in a good faith interactive process with the applicant to explore accommodations that will be effective, reasonable and not create an undue hardship.

You can see how this popup was set up in our step-by-step guide: https://wppopupmaker.com/guides/auto-opening-announcement-popups/

You can see how this popup was set up in our step-by-step guide: https://wppopupmaker.com/guides/auto-opening-announcement-popups/