Part One: A Case for Affordable Housing

Seeking Investment Stability During a Recession Authored by Trevor Schuesler, CFA, Associate Investment Director February 22, 2021 Since the...

March 16, 2021

John Burr Williams’ 1938 text, “The Theory of Investment Value” was one of the first theories to propose investment assets had an intrinsic value and, more importantly, those intrinsic values could be estimated as the present value of expected future cash flows. Today, almost all investors draw on Williams’ work to identify attractive investment opportunities. These opportunities exhibit some combination of attractive current yield and future growth, both of which are becoming harder to find in 2021.

Yields on U.S. Treasuries have had a monotonic decline every decade since their peak in the 1980s at 15%. They bottomed at about ½ of a percent in 2020 before rebounding to just over one percent at the time of this writing. Starting yields are similarly startling in equity markets where the average dividend yield on the S&P 500 ended 2020 at 1.6% – the lowest level since the tech bubble. Real estate yields, expressed as “cap rates,” have fared much better in a current range of 3-9% depending on property type, but they too have seen a decline to levels not seen since the financial crises. So where can investors find return with such depressed starting yields?

With two primary pieces of Williams’ equation, starting yield and future growth, investors are approaching the low yield conundrum differently. Fixed income investors are adopting alternative credit strategies in search of higher starting yields. Equity investors are seeking high growth stocks in hopes of higher future cash flows. Real estate investors, by our accounts, are still refining their strategy. However, we would suggest a “having your cake and eating too” strategy that seeks the higher yields AND higher growth rates inherent in affordable housing. For brevity’s sake, this article will focus on the lesser known and lesser understood growth side of the equation of affordable housing, but it should be noted that affordable properties enjoy cap rates that are 50-100 bps higher than their market rate “comps.”

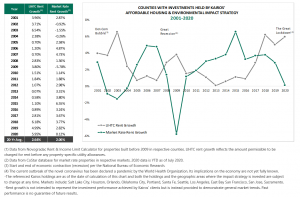

What surprises investors is that affordable properties, best known for rent control, enjoy higher average rent growth compared to market rate properties. As seen in the chart on the next page, LIHTC (Low Income Housing Tax Credit) properties have averaged an annual growth rate that is almost 60 bps higher than that of market rate properties. However, the more compelling aspect of the outperformance is that it is strongest during periods of economic contractions, when investors need it most. In previous crises and recessions, affordable housing rent growth has demonstrated a resilience and stability not seen in market rate housing. That resilience was apparent during the Great Recession and has thus far persisted through the Great Lockdown (COVID-19 pandemic). The reason for this growth advantage among affordable properties is two-fold: 1) consistently high demand and constrained supply, and 2) artificially low starting rents.

Most of us have a fleeting memory of supply and demand equilibrium from our high school economics class. It says that if demand outstrips supply (as is the case with affordable housing), price needs to increase to meet equilibrium (i.e., rents need to go up). Therefore, affordable housing sees a consistent bid for units at prices that are higher than they are currently being offered. These supply and demand dynamics are heavily influenced by artificially low starting rents (rent caps) mandated by HUD in the case of LIHTC properties. However, HUD allows for those rent caps to rise over time by utilizing a formula that includes a combination of one-year and five-year trailing income growth metrics. For context, U.S. per capita income has never fallen on a five-year basis since the U.S. Census started collecting the data in 1967. This formula results in a consistent and meaningful increase in annual rent caps and consistent and meaningful rent growth for affordable properties.

These are peculiar times that leave investors of all types with a dearth of compelling investment options. However, when you layer in the higher yield, growth, and stability of affordable properties relative to their market rate comps, we believe affordable housing deserves consideration.

To review Part One of this series, Seeking Stability During A Recession, follow the entitled link for a discussion of the stability inherent in affordable housing. For questions, contact investor relations at investorreporting@kimc.com or 949-800-8500.

*Certain information contained herein has been obtained from third party sources and such information has not been independently verified by Kairos. No representation, warranty, or undertaking, expressed or implied, is given to the accuracy or completeness of such information by Kairos or any other person.

** There are no guarantees that any specific investment strategy will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss.

Back to All

Back to All

Seeking Investment Stability During a Recession Authored by Trevor Schuesler, CFA, Associate Investment Director February 22, 2021 Since the...

By Jonathan Needell, President & Chief Investment Officer July 27, 2023 Kairos recently made the move to a new...

Thoughts on the Economic Ramifictions of the COVID-19 Pandemic Authored by Jonathan Needell, President & Chief Investment Officer July...

By Heather Lewis, Chief Compliance Officer and Jeanna Mackin, Associate Director of Human Resources August 9, 2023 Over the...

Authored by Jonathan Needell, President and Chief Investment Officer April 30, 2021 Commercial real estate’s various sectors always have...

Authored by Jonathan Needell, President & Chief Investment Officer August 28, 2020 In the United States, the ongoing COVID-19...

By Justin Salvato, Senior Partner at Kairos Investment Management Company October 23, 2023 Not long ago, capital deployment was...

Authored by Jonathan Needell, President and Chief Investment Officer April 27, 2022 The debt markets are under a considerable...

18101 Von Karman, Suite 1100

Irvine, CA 92612

(949) 709-8888

(949) 800-8500

investorreporting@kimc.com

Copyright © 2024 Kairos Investment Management Company | Disclosures

Kairos Investment Management Company is an Equal Opportunity Employer and, as such, does not discriminate in employment on the basis of an applicant or employee’s race, ethnicity, ancestry, national origin, color, sex, pregnancy (or related medical conditions), childbirth, family status, gender, gender identity or gender expression, age, religion, marital status, sexual orientation, disability, medical condition, military or veteran status, reproductive health decision making, or any other protected classification or characteristic under applicable federal, state or local law. Kairos will not discriminate against an applicant or employee who has one or more protected classifications, is perceived or regarded as having one or more protected classifications, or is associated with someone who has one or more protected classifications.

Kairos Investment Management Company will also provide reasonable accommodations to applicants and employees who may need such accommodations in connection with employment with Kairos on the basis of their disability, religion, status as a victim of domestic violence or pregnancy. An applicant who needs an accommodation in order to pursue employment with Kairos should contact Human Resources at HR@KIMC.com to request such accommodations. Kairos will engage in a good faith interactive process with the applicant to explore accommodations that will be effective, reasonable and not create an undue hardship.

You can see how this popup was set up in our step-by-step guide: https://wppopupmaker.com/guides/auto-opening-announcement-popups/

You can see how this popup was set up in our step-by-step guide: https://wppopupmaker.com/guides/auto-opening-announcement-popups/